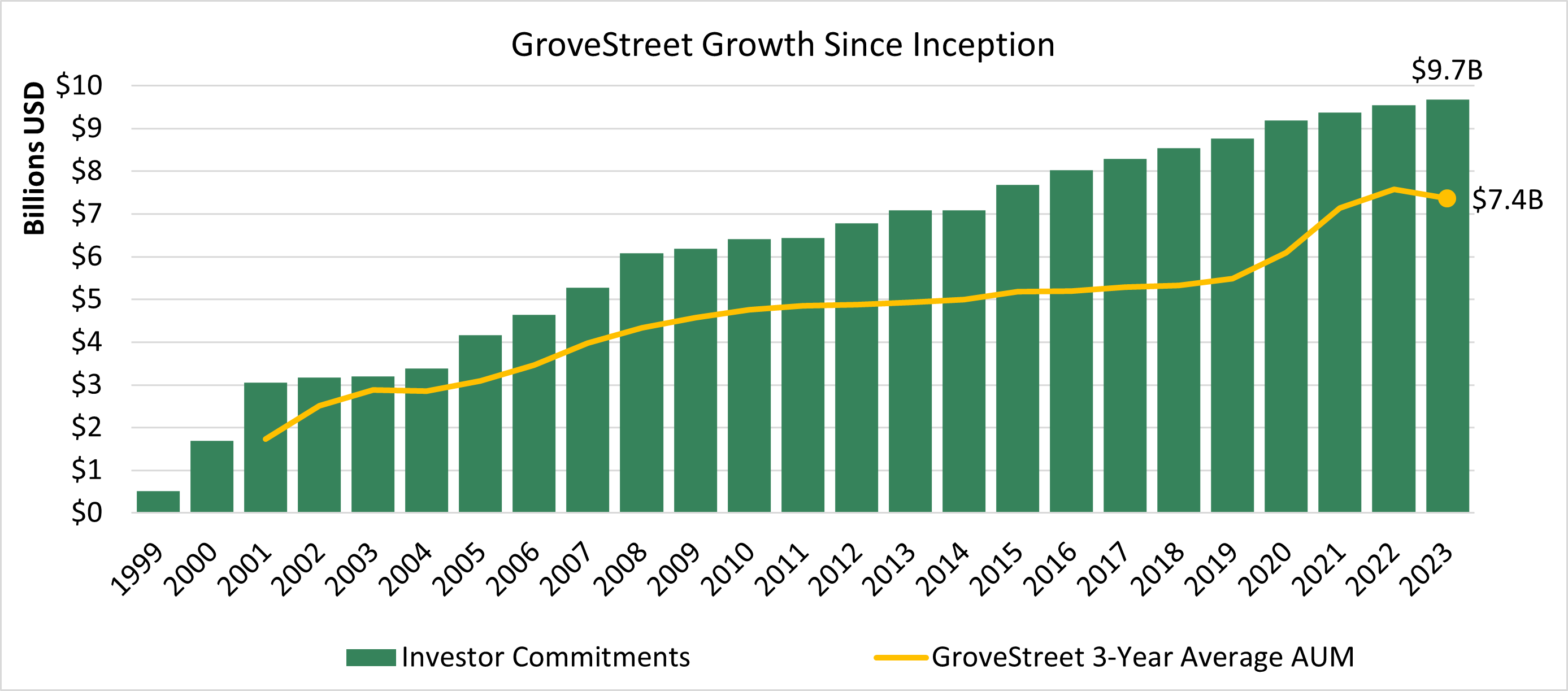

Partnering With Us

At GroveStreet, we collaborate with our investors to develop truly custom portfolios. We strive to add value by creating agile access to private equity and venture teams that are transforming the companies and markets in which they invest.

GroveStreet invests with teams that transform companies and markets. We run our investment process to free the teams we back to do what they do best, and we stand reliably alongside those who deliver through multi-decade relationships.

What we look for in a partner:

- A focus on creating fundamental enterprise value, whether through revolutionary technology in venture capital or through business transformation in buyouts

- Best-in-class expertise in particular industry segments, technologies, geographic areas, operational strategies or other capabilities that distinguish the team from the broad, general market

- A quantifiable and verifiable history of success in areas of investment focus

- A team that is built for continued long-term success

- Alignment with GroveStreet and our investors to focus on terminal performance

GroveStreet Investment Criteria & Process

For Venture Teams

GroveStreet invests with leading IT and life science venture teams in the US, Europe and Asia, and is a reliable LP across market cycles. For example, since inception we have backed 15 General Partners through six or more funds. Many of these relationships began with first-time teams that have gone on to become premier firms in their respective markets. We are enthusiastic about technology and its transformational impact on people, companies and industries across the globe.

For Private Equity Teams

GroveStreet invests with buyout teams focused on the lower mid-market in the US and Europe as well as growth equity teams in Asia. We frequently back first-time funds led by teams with proven expertise in their areas of focus. Over time, we often scale with teams or facilitate direct relationships with our investors as GPs grow. We are proud to partner with teams that have the expertise to transform under-performing companies into market leaders, spot market trends ahead of the masses, and see value where others fail to identify opportunity.

Our Process

GroveStreet’s Partners have worked together for an average of 19+ years. We know what we are looking for in a GP, and are quick to communicate. We seek to focus our in-depth due diligence on investments likely to be completed. Once we invest, we are a stable, reliable, common sense partner.

Our Flexibility

GroveStreet provides ease, flexibility and stability. Your point of contact is solely GroveStreet unless you wish to develop a relationship with our underlying global client base. Your fund size should be driven by your opportunity, not our capital requirements. Our structure allows us to make a small commitment for one investor where it is a particular fit, or combine clients to bring substantial capital to the table.

GroveStreet specializes exclusively in managing separate accounts with flexible, custom mandates that support our investors’ goals. The investment process is transparent to the investors who also enjoy fully integrated access to our robust finance, accounting and reporting team.

GroveStreet Separate Account Benefits

Performance Driven

GroveStreet is structurally and culturally a performance-driven investment firm focused on our investors’ terminal returns. We are not an asset gathering company driven by AUM fees. The compensation and incentives of GroveStreet’s Partners are dependent on building a long-term sustainable business that delivers strong performance across cycles.

Investing Alongside Programs

GroveStreet’s long-term performance orientation is underpinned by a significant personal investment by the Partners alongside every investor program. Because compensation includes a profit sharing component, GroveStreet defines success by the actual end-returns that it generates, while being sensitive to interim IRRs.

True Customization

GroveStreet’s separate account model allows for a complete customization of the charter and flexible adjustments to the strategy over the life of the program. This is a differentiating factor from managers with a large number of investors or competing co-mingled fund-of-funds that may also offer separate accounts, largely identical to one another. The flexibility of our separate account structure was particularly evident when the 2008 financial crisis unfolded. We were able to decrease the investment pace for some investors, moderate investments in certain private equity sub-strategies for others and increase the pace for another investor that wished to take advantage of opportunities in the secondary market and venture capital.

Knowledge and Relationship Transfer

Investors can build direct relationships with our private equity and venture teams based on their organizational preferences, ranging from minimal contact to development of a direct investment relationship over time with support from GroveStreet. Investors can rely wholly on our finance and reporting systems, integrate our data outputs into their systems or turn to our team for training and systems development in their own organizations.

Primaries, Secondaries and Co-Investments

The design of a GroveStreet custom mandate starts with the requirements of the investor. We create value through primary fund commitments, strategic secondary purchases and sales, and co-investments.

Expert Reporting

GroveStreet operates state-of-the-art accounting and reporting systems with a highly experienced in-house staff that handles many functions out-sourced at other firms to deliver superior knowledge, accuracy and access to information. These systems are fully customized to individual investor needs. Investors directly access the skills and expertise needed from any GroveStreet finance team member for ease of use and maximum expertise.

Investor Scenarios

Knowing the Future

Access and Market Coverage

Organizational Complexity

Learning the Industry

Investing with Purpose

Evolving to Address Climate Change

Send Us an Email